According to Wikiplast, during the half-closed week in the polymer market, expectations did not meet expectations and witnessed a drop in the volume of dealings, which is not a positive signal for the market.

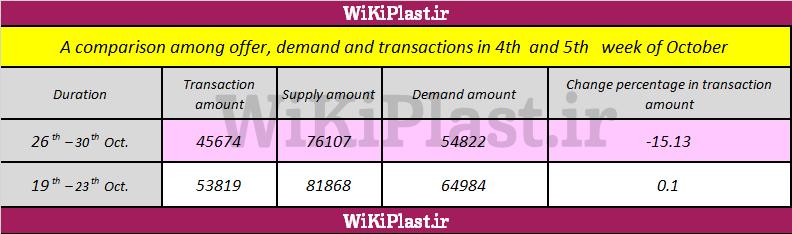

Last week, we witnessed a 15 % fall in the trade exchange of polymers at the commodity exchange, which resulted in a decline in the volume of trade registered to the lowest number of weeks leading up to 12 September, i.e. the market has returned to the pre-boom period.boom.

However, supply volumes have dropped to the lowest level of weeks leading to 21 August, which could be one of the main reasons for decreasing the volume of transactions.

For two weeks, the fluctuation of basic prices in commodity exchanges has been minor and the market has resisted the drop in prices. However, reducing the volume of polymers on the stock exchanges has considered the most important event that has registered in recent weeks. and if we do not see demand return, new concerns will play a role.

Aside from the drop in supply volumes on the stock market, half-week closing was the second reason for the drop in volume, which is not the same as a drop in supply.

However, the polymer supply on the commodity stock has reduced for four weeks on the path that the conditions will deteriorate if the trend continues.

However, for the coming week, the hope for growth is not unexpected, and it can dispel a fraction of the concerns. While the difficulty of exporting to Iraq in recent weeks and during the Arbaeen was one of the reasons that justified the decline in purchasing attractiveness, but it has now made a new face

The closure of the Mehran border, along with rumors of continued cargo movement from the Khosravi border to the unchanged border of Iraqi Kurdistan, are all adding to the complexity of Iraqi events, although we do not expect the situation to return to its normal course in the short term.

Rumours have suggested that part of the demand for end products in the polymer industry has fallen, which is in line with the output of polymer trading on the commodity exchange.

Of course, the rainfall and half-closure of the past week are some cases that can justify such a retreat, but the continuation of these conditions is worrisome.

On the other hand, we see that the market is resisting to the drop in prices as possible, while the volume of commodity stock exchanges has been in general decline several weeks, and the stocks of warehouses are decreasing.

These still points to the potential for market resistance to price declines, but in the end stock market prices will determine the final rates.

The depreciation of the dollar is also present, but this week it will have the process of declaring the basis of its specific complexity, which limits the possibility of explicit comment.

However, the conditions in the polymer market for the week that have passed are not very attractive, and even the volume of transactions in this week did not meet expectations, although there is potential for growth in polymers trading volume in the next week.

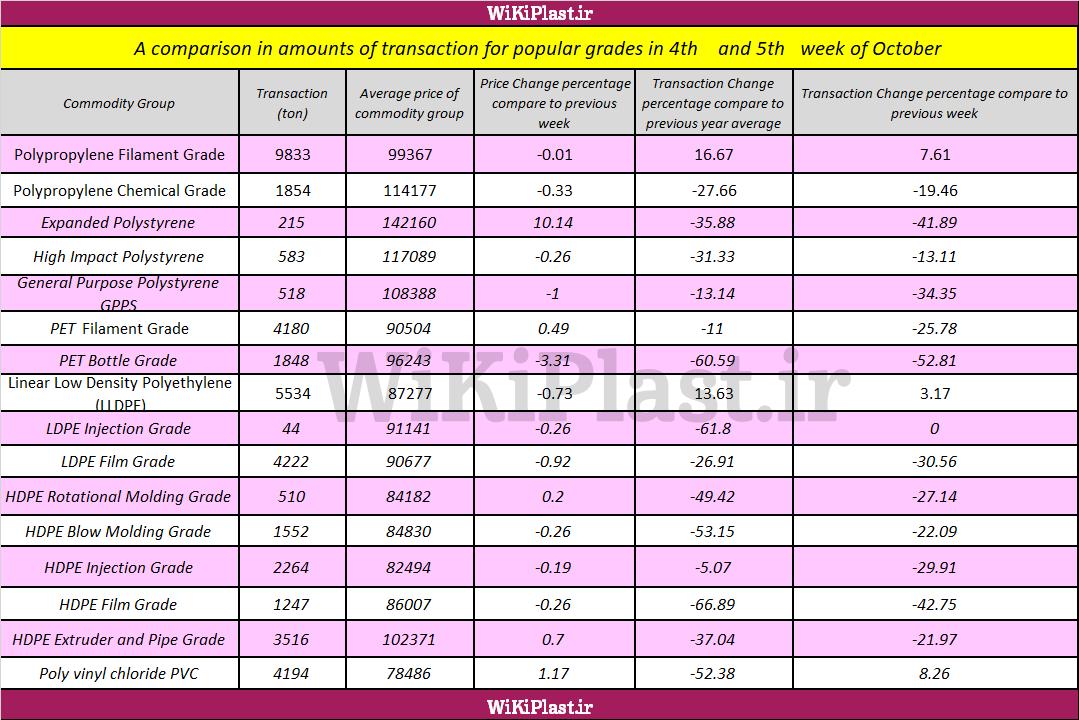

An important feature of last week's dealings, the tangible growth of polystyrene prices was significant, particularly the 200 and 300.

The state of trading for PCV was also significant, and there were competitions in the market.

Write your comment

Related contents

- Disregard of Polymer Market for USD Rate

- تقاضا پشت سد کدهای تعلیق شده

- اثر هفتهای نیمهتعطیل بر بازار پلیمرها

- مقاومت جدی بازار پلیمرها

- سرعتگیرهای افت حجم معاملات پلیمرها

Wikiplast

Wikiplast