A report on Petrochemical products market, Second week of September 2019

Growing trade rate in a week with many holidays/ Last steps before passing recession

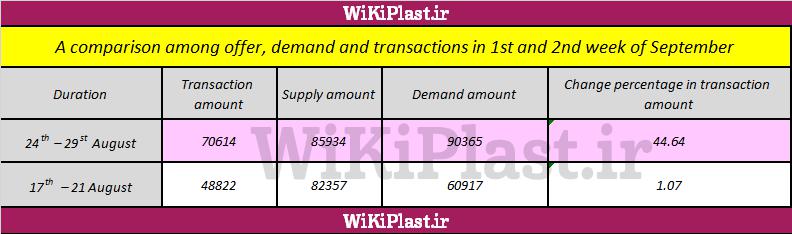

According to Wikiplast, regarding the possibility of decreasing base prices, growing trade rate in a week with many holidays is out of habit for polymer market. If the current situation continues, serious phase shift can be expected through basic data.

If the trade rate continues rising in a week that lower prices are expected, we can predict something is up.

The trade rate has been just below 50,000 tons, which is considered a threshold for recession. This means there has been a significant change in the situation of the market. If the current circumstances persist, we can be definite about the end of the recession.

In the past two weeks, the market has been in the best condition since June, which is roughly when the recession started. If the trade rates surpass the threshold of 50,000 tons, we can say the end of the recession is here.

In the current circumstances, a rise in trade rates can be a huge step.

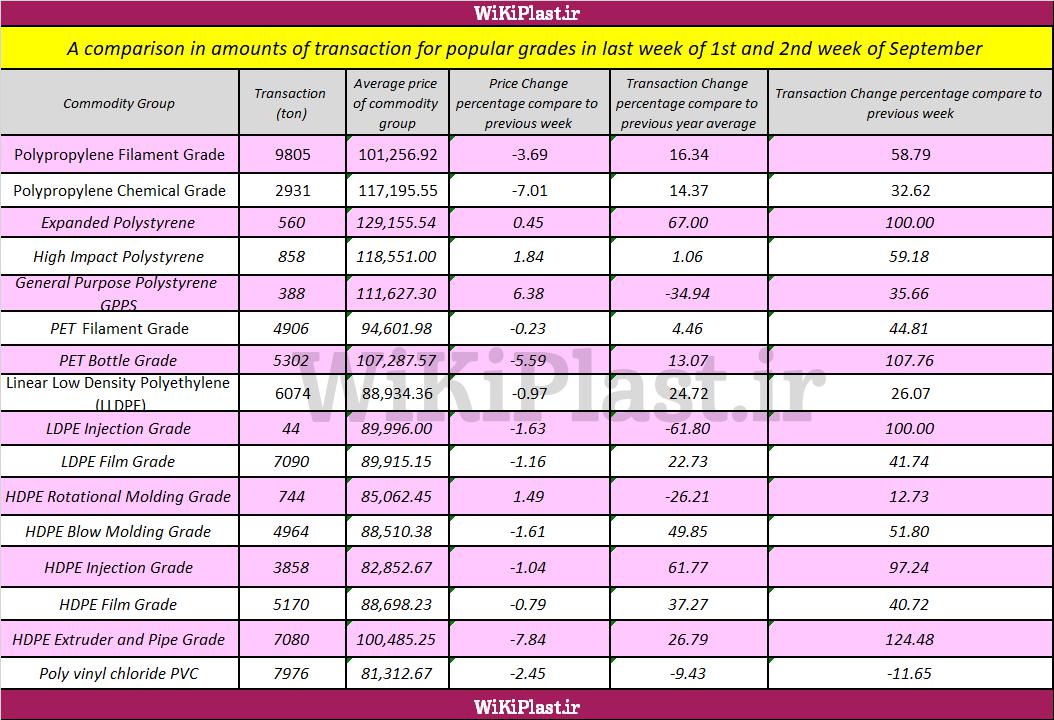

The prices are still suspected to fall further this week, but according to the market, the real demand plays a role here rather than fluctuations in prices.

Currently, the attitude of the market is more based on production rather than brokerage.

For the real manufacturer, the fluctuations in price seem insignificant comparing to the profit margins of production. They will need to get hold of their raw material, which could as well be provided by the stocks market.

The fluctuating prices in free market shows that it has some resistance against the falling prices of the stocks market.

This is due to low inventory stocks and it makes the demands reasonable, despite the decreasing prices.

The gap between governmental and free exchange rate is widening.

This can make exporting reasonable and increase the potential demand in domestic market.

And all this happening in a week with many holidays can emphasize the fact that the rise in demands is real; A surprising yet promising fact.

According to the growth that the market experienced this week, the trade rates are expected to go higher in the following week.

The leaping oil price is at least a positive mindset for the active members of the market. We cannot shoot for far predictions. We can say that decreasing prices are estimated but no exact prediction can be made until the prices are actually declared.

Write your comment

Related contents

- Serious resistance of the polymer market

- What can prevent Polymer trade rates from dropping?

- Continuous improvement and the consequences of changes in the market

- Persistent pessimism in the market

- New hopes for further rise in demands

- Ongoing decrease in offers and trades

- Diminished offers and low trade rates

Wikiplast

Wikiplast